Here Is the Future of Brand-to-Brand Partnerships

No advertiser aims to serve an irrelevant offer. Still, if the trends impacting brand-to-brand partnerships are anything to go by, we’re set to see a divide between brand collaborations built for the future and those destined to be phased out.

Until now, retail ‘hosts’ (those driving revenue by highlighting rewards from third-party advertisers) have been quick to favour the best advertisers or the biggest offers. Global household names are supposed to carry the biggest appeal; the deepest discount is supposed to resonate with customers.

In reality, retailers treating brand-to-brand partnerships as a key source of revenue are starting to ask advertising’s age-old questions.

The end goal is still ‘right message, right customer, right time’. But what does that look like in this context?’

Using first-party data in brand-to-brand partnerships

Suppose brand-to-brand partnerships really do form part of the retail media mix labelled as advertising’s fastest-growing segment. In that case, we have to put nascency aside and respect the same rules around how higher-performing campaigns generally factor in some form of relevance.

Many retailers now deploy cross-selling and upselling messages around their product pages and checkout. As with all forms of recommendations, what often makes these strategies effective is their relevance. The first big step in brand to brand’s relevance journey will see the same first-party data inform which partners are highlighted.

There’s a simple example of how this can work in all retail sub-industries. For a strong example, let’s focus on fast-moving consumer goods (FMCG).

Brand-to-brand relevance in action

Brand-to-brand partnerships have become a vital acquisition tool for an array of subscription-based FMCG businesses. From streaming services to more obscure concerns like pet food, there is a big demand for brand partners.

Using the latter as an example, if the goal is to ‘complete’ a purchase, insurance providers are an obvious partner. They can either showcase rewards pre-purchase – the insurer potentially leveraging a free month’s subscription as an incentive to buy cover – or post-purchase with an order confirmation.

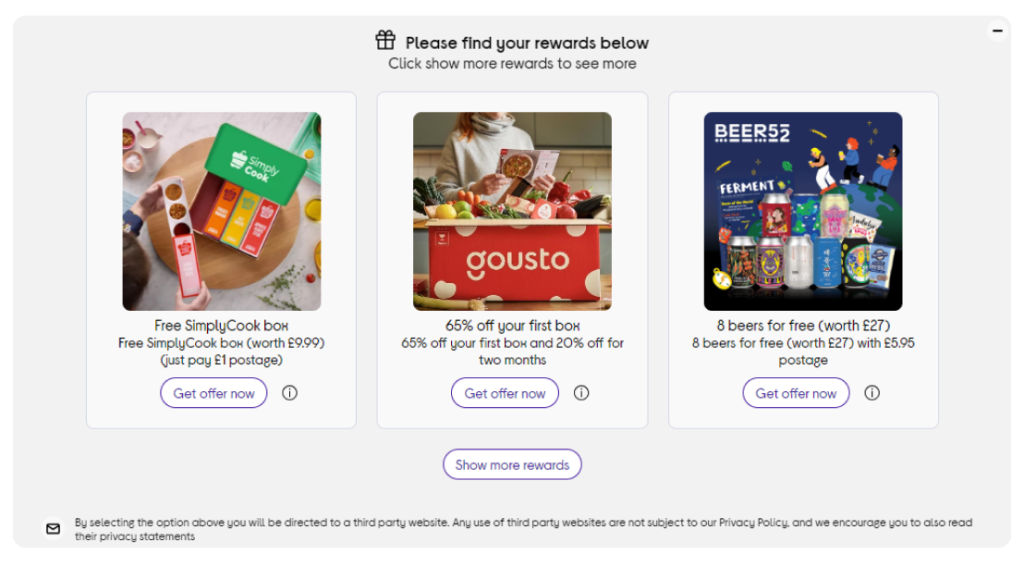

Matching rewards to basket contents is one way we’ve helped retailers using BrandSwap’s technology to enhance their brand-to-brand partnerships. Retailers get the opportunity to create premium inventory. Advertisers get closer to a relevant audience. Meanwhile, those audiences get a gift or reward that complements their purchase.

Holding brand partner rewards to the same standards as product recommendations will influence crucial changes in perception. Inevitably, this will translate to much better results for advertisers and customers.

Learning what works in brand-to-brand partnerships

With other data points, retailers and advertisers will rely less on their knowledge of purchasing and more on experimentation.

We already know that certain brand partners resonate better with younger audiences. However, A/B testing will soon become vital for gauging the effectiveness of different offers, challenging preconceptions, and seeing what audiences actually respond to.

Remember, in this arena, customer satisfaction goes hand in hand with partner satisfaction. The ongoing challenge for retail hosts is to create premium inventory. Part of that puzzle requires understanding which type of reward will convert and when.

Recently, BrandSwap was challenged by electrical retailer Currys to analyse preferences for brand partner rewards over a typical year. Alcoholic beverage subscriptions increased in demand over winter as customers stocked their cupboards ahead of Christmas. As the festivities drew to a close, meal kits and health foods spiked as customers looked to embrace good habits.

Currys gained an idea of which rewards to show at the start and end of the year. Perhaps more importantly, it also gained a data-backed opportunity to pass onto specific types of partners.

Case study: a recipe for brand-to-brand relevance

On the other side of the fence, advertisers will tap into the same benefits as retailers by prioritising relevance. A great example of a high-performing partner taking advantage of an audience overlap is SimplyCook.

This year, BrandSwap has helped SimplyCook partner with UK electrical retailers like Currys and Hughes to promote a free month’s trial of its recipe box subscription service in places where customers are most likely to buy new kitchen appliances.

At Currys, the use of our Smart Post-Checkout Rewards solution means that after completing a purchase, customers see the trial offer from SimplyCook and instructions on how to redeem it.

At Hughes Electrical, Simply Cook adds an extra tier of coverage by targeting customers pre-purchase, giving them a free trial in exchange for placing an order.

Highlights from the results include:

- Launching a test campaign that generated over 1,000 trials on a target of 50

- Within four months, driving nearly 4% of SimplyCook’s partnership conversions

- Delivering trialists who were 8% more likely to convert into subscribers

Tackling relevance at scale

Finally, what would any analysis of the imminent future be without a mention of artificial intelligence?

Looking specifically at brand-to-brand partnerships, we see an opportunity for retailers to build models that identify the most suitable rewards to highlight based on thousands of past interactions.

That data will draw conclusions that may never have been considered, establishing hidden links between products, categories, audiences, and partners.

AI’s involvement will make it far easier for retailers to tackle and apply relevance at scale and potentially justify an expansion of partners. Soon, the lure of bigger experiments could see customers presented with a greater number of rewards to see which proves most popular.

Just about every marketing channel, from paid social to display, has made great strides in boosting its targeting capabilities and clamping down on irrelevance. It’s now time for brand-to-brand partnerships to start the same journey.

This feature originally appeared in Awin’s Q3 2024 Brand Partnership Insights report. For more insights, view the full PDF.

Alternatively, if you’re ready to start on your own brand-to-brand journey as an advertiser or retail host, contact us to get BrandSwap live via the Awin Mastertag’s one-click integration.

Available through one-click activation on Awin and ShareASale

Get in touch

Enter your details below and we will get in touch regarding next steps